http://www.washingtonpost.com/

Someone you probably are not familiar with has filed a suit you probably have not heard about concerning a four-word phrase you should know about. The suit could blow to smithereens something everyone has heard altogether too much about, the Patient Protection and Affordable Care Act (hereafter, ACA).

Scott Pruitt and some kindred spirits might accelerate the ACA’s collapse by blocking another of the Obama administration’s lawless uses of the Internal Revenue Service. Pruitt was elected Oklahoma’s attorney general by promising to defend states’ prerogatives against federal encroachment, and today he and some properly litigious people elsewhere are defending a state prerogative that the ACA explicitly created. If they succeed, the ACA’s disintegration will accelerate.

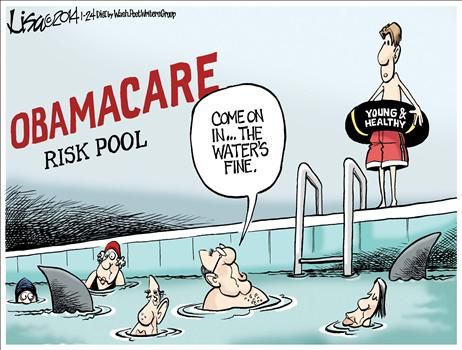

Because under the ACA, insurance companies cannot refuse coverage because of an individual’s preexisting condition. Because many people might therefore wait to purchase insurance after they become sick, the ACA requires a mandate to compel people to buy insurance. And because many people cannot afford the insurance that satisfies the ACA’s criteria, the ACA mandate makes it necessary to provide subsidies for those people.

The four words that threaten disaster for the ACA say the subsidies shall be available to persons who purchase health insurance inan exchange “established by the state.” But34 states have chosen not to establish exchanges.

So the IRS, which is charged with enforcing the ACA, has ridden to the rescue of Barack Obama’s pride and joy. Taking time off from writing regulations to restrict the political speech of Obama’s critics, the IRS has said, with its breezy indifference to legality, that subsidies shall also be dispensed to those who purchase insurance through federal exchanges the government has established in those 34 states. Pruitt is challenging the IRS in the U.S. District Court for the Eastern District of Oklahoma, and there are similar challenges in Indiana, Virginia and Washington, D.C.

The IRS says its “interpretation” — it actually is a revision — of the law is “consistent with,” and justified by, the “structure of” the ACA. The IRS means that without its rule, the ACA would be unworkable and that Congress could not have meant to allow this. The ACA’s legislative history, however, demonstrates that Congress clearly — and, one might say, with malice aforethought — wanted subsidies available only through state exchanges.

Some have suggested that the language limiting subsidies to state-run exchanges is a drafting error. Well.

Some of the ACA’s myriad defects do reflect its slapdash enactment, which presaged its chaotic implementation. But the four potentially lethal words were carefully considered and express Congress’s intent.

Congress made subsidies available only through state exchanges as a means of coercing states into setting up exchanges.

In Senate Finance Committee deliberations on the ACA, Chairman Max Baucus (D-Mont.), one of the bill’s primary authors, suggested conditioning tax credits on state compliance because only by doing so could the federal government induce state cooperation with the ACA. Then the law’s insurance requirements could be imposed on states without running afoul of constitutional law precedents that prevent the federal government from commandeering state governments. The pertinent language originated in the committee and was clarified in the Senate. (See “Taxation Without Representation: The Illegal IRS Rule To Expand Tax Credits Under The PPACA,” by Jonathan H. Adler and Michael F. Cannon in Health Matrix: Journal of Law-Medicine.)

Also, passage of the ACA required the vote of every Democratic senator. One, Nebraska’s Ben Nelson, admirably opposed a federal exchange lest this become a steppingstone toward a single-payer system.

If courts, perhaps ultimately including the Supreme Court, disallow the IRS’s “interpretation” of the law, the ACA will not function as intended in 34 states with 65 percent of the nation’s population. If courts allow the IRS’s demarche, they will validate this:

By dispensing subsidies through federal exchanges, the IRS will spend tax revenues without congressional authorization. And by enforcing the employer mandate in states that have only federal exchanges, it will collect taxes — remember, Chief Justice John Roberts saved the ACA by declaring that the penalty enforcing the mandate is really just a tax on the act of not purchasing insurance — without congressional authorization.

If the IRS can do neither, it cannot impose penalties on employers who fail to offer ACA-approved insurance to employees.

If the IRS can do both, Congress can disband because it has become peripheral to American governance.

Read more from George F. Will’s archive or follow him on Facebook.

No comments:

Post a Comment